December 1, 2023

My oldest son recently began kindergarten, sparking what we hope will be a lifelong love of reading and writing. It is exciting to watch him master short, introductory “sight words” and move on to more challenging literary components, progressing past children’s books to chapter books. In what may end up being a similar progression, the stock market’s performance in 2023 has been overwhelmingly dominated by a handful of technology companies that over the years have gone by various easy-to-remember acronyms. If the past is prologue, the current narrow focus of investors’ attention on this simple and select few may overlook the rich and vibrant opportunity presented by other high-quality companies around the world.

For those who are not familiar with “sight words” (as I was not until recently), this term refers to words that children learn early on to recognize by sight – without needing to go to the trouble of sounding them out. Examples including the, it and to tend to make up about 75% of beginner-level books. Thus, familiarity with these words can help children feel less overwhelmed while building fluency.

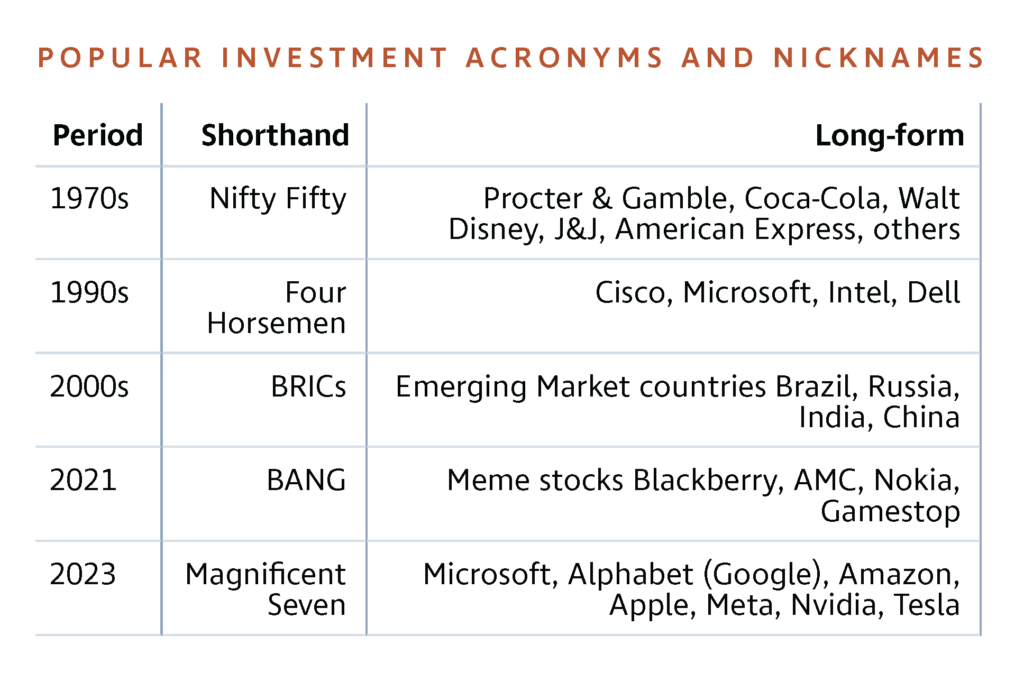

Similarly, a novice investor could reasonably begin studying the stock market by evaluating the most well-known companies. Readers may have heard the term “Magnificent Seven” used to describe the well-known companies which have collectively accounted for nearly 75% of the S&P 500’s returns in 2023 as of the date of this writing. This table highlights other common nicknames referenced in the investment news over the years.

It is not a new phenomenon for a handful of holdings to capture investors’ attention with their growth and innovation. However, in previous cycles, many of these holdings went on to underperform the broader market after excitement peaked, even if the underlying businesses continued to thrive. The Four Horsemen once accounted for a similarly large proportion of stock market movement to today’s Magnificent Seven. Yet, an equal-weighted basket of those four stocks fell 71% from December 31, 1999 to December 31, 2009 while the S&P 500 fell 9.1%. The BRICs outperformed other geographies for years before peaking in 2007 and underperforming the S&P 500 by 125% the following decade. Ultimately, just as the library of literature created by humanity over centuries is vastly richer than mere children’s books, the overall stock market is a massive, dynamic, wealth-creating machine containing thousands of companies competing to innovate and grow. A myopic focus on today’s leaders could cause an investor to miss out on opportunities below the surface of the overall market’s performance.

How many eggs in your basket?

We often say our investment strategy is best defined by the investments we do not own, rather than solely focusing on what we do own. We are not averse to the idea of concentrating portfolios into what we feel are the best opportunities available at a given time. Our philosophy focuses on time-tested businesses of the highest quality and the bonds we purchase are from issuers with high credit standards. Thus, we pass on the majority of the approximately 57,0001 globally listed stocks and 100,0002 unique bond issuers. A typical Hamilton Point portfolio is invested in only about 0.1% of potential stocks and 0.02% of potential bonds they could own! To paraphrase Andrew Carnegie, we prefer to carefully select only the eggs we believe are best for our basket and then watch that basket carefully.

As exclusive as our premium list may first appear, in many ways our portfolios are more diversified than current broad market indices weighted by company size. For example, the Magnificent Seven account for ~28% of the value of the entire S&P 500 index as of October 2023. A typical Hamilton Point equity portfolio has ~19% of its value in its largest seven holdings, three of which are companies operating in industries other than technology.

Behind the hype

While reasons for this year’s dramatic outperformance of the Magnificent Seven are multifaceted, investors apparently believe these seven may benefit disproportionately from advances in machine learning and artificial intelligence (AI). In an interview on 60 Minutes earlier this year, Sundar Pichai, CEO of Google’s parent company Alphabet, described AI as “the most profound technology humanity is working on. More profound than fire, electricity, or anything that we have done in the past.” While no one from Hamilton Point was present for the invention of fire or electricity, the internet was a similar society-transforming innovation of our time. Many of the perceived winners from the early days of the internet ended up being relative disappointments for their investors when hype got ahead of business fundamentals – early market darlings AOL, Yahoo! and Cisco come to mind. If AI fundamentally transforms aspects of our world (which, to be clear, we do think is a likely outcome), there is no guarantee that investors will have correctly chosen the seven companies that will have enduring investment returns from the new technology, any more than they were able to choose the winners of previous innovation cycles.

The relatively poor performance by much of the rest of the stock market could also be justified by this belief that the primary beneficiaries of AI will be the tech leaders, while other companies will see little impact on their productivity or profitability. In our view, the eventual outcome may be the opposite: just as technologies like the printing press, the personal computer, and the internet transformed broad swaths of the economy, AI appears likely to prove beneficial across many industries. For example, John Deere launched “See and Spray”3 last year, a product which uses machine learning to distinguish crops from weeds, thereby directing herbicides only where needed. Nike uses a combination of computer vision and AI to power “Nike Fit,”4 an app which takes a 15-second scan of your foot to optimize shoe size to order direct from their website. RELX Group is using generative AI tools to help lawyers create legal contracts, assist doctors in diagnosing and treating patients and enable scientists to model complex interactions of proteins and molecules in the pursuit of new drugs and disease treatments.5 Each of these examples have been in development and use for years, long before the recent stock market hype in 2023.

The next chapter

As the holidays approach with shorter days and time to catch up on your reading, we encourage you to look beyond the latest catchphrase dominating headlines (and market performance). There are many high-quality, cash-producing, innovative companies being passed over by investors which, in our view, represent relative bargains. Just as my son will advance beyond basic word formulations to the works of Shakespeare and Dickens, so too will financial markets and investors eventually find opportunity outside of the Magnificent Seven.

All market data is sourced from Bloomberg unless otherwise noted.

1. https://www.world-exchanges.org/

2. https://www.icmagroup.org/market-practice-and-regulatory-policy/secondary-markets/bond-market-size/

3. https://www.popsci.com/technology/john-deere-tech-evolution-and-right-to-repair/

4. https://www.cnbc.com/2019/05/08/nike-is-launching-nike-fit-to-scan-your-feet-tell-you-your-shoe-size.html

5. https://www.relx.com/our-business/perspectives/categories/ai-and-technology.